Actions 1.04 and 1.05 guide the Province’s work to co-develop a new fiscal relationship and framework with Indigenous Peoples. The Province is consulting and co-operating on both actions through a single engagement process.

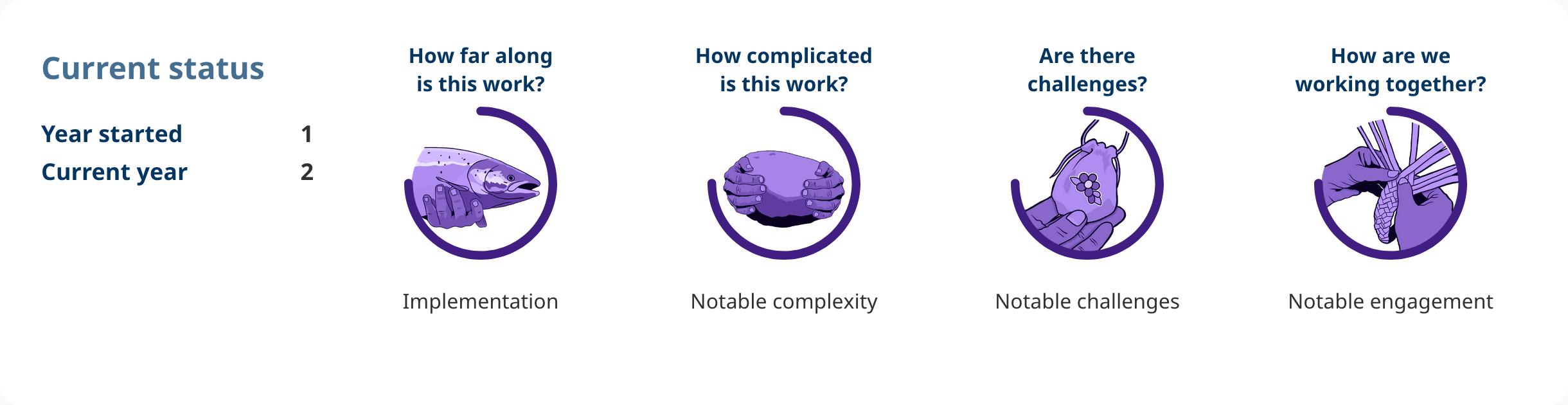

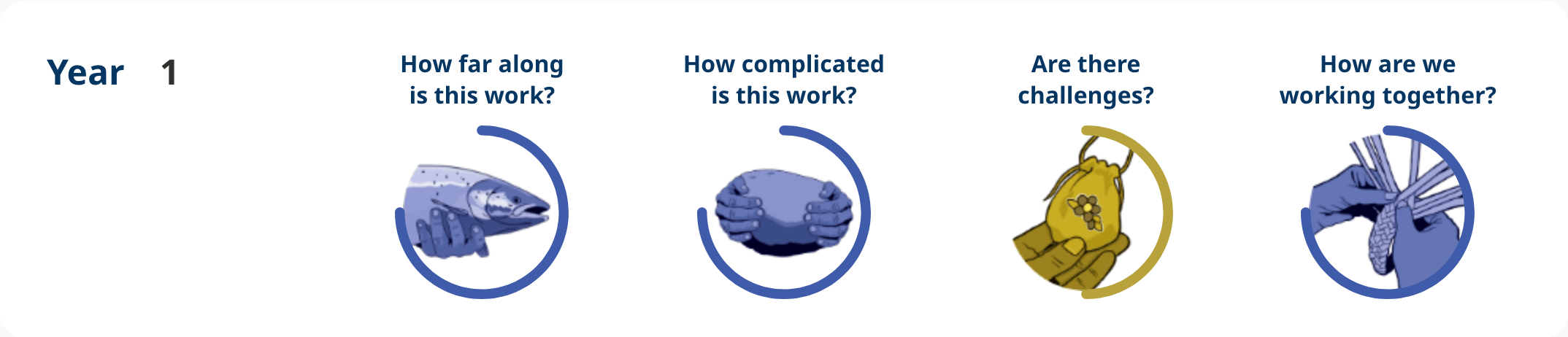

How are we working together?

Actions 1.04 and 1.05 guide the Province’s work to co-develop a new fiscal relationship and framework with Indigenous Peoples. The B.C. government is consulting and co-operating on both actions through a single engagement process.

Working together, the Province is building a stronger B.C. through partnerships and agreements that create economic opportunities, good jobs, and help build a better future for all.

The Ministry of Indigenous Relations and Reconciliation is continuing to plan next steps on the co-development of a new fiscal framework. Engagement to date has reinforced the complexity of this work. An evolving fiscal and political climate has signaled the need to assess how a new fiscal framework will support shared objectives. This includes recognizing First Nations rights, advancing self-governance and self-determination, as well as adapting and supporting the broader economy for all British Columbians in the face of tariffs and economic uncertainty.

Work with the Alliance of BC Modern Treaty Nations is also being advanced and is reported on under Action 4.49.

Are there challenges?

This work was paused during the provincial election and lengthy post-election period, only to be resumed in the context of significant economic and fiscal uncertainty.

A constrained and potentially volatile fiscal climate across all levels of government and general economic uncertainty has added significant complexity for the Province in co-developing a new fiscal framework. In light of this, new approaches to advancing work under these actions may be required.

Highlights

The Province has continued to review and consider the significant input from First Nations received over the previous two years. The Province continues to explore opportunities for renewing co-development of a New Fiscal Framework with First Nations in this new environment.

In support of economic reconciliation, the Province is working with First Nations and the B.C. business sector to develop strong economic partnerships. To support this work and create economic growth, the Province announced the intent to develop what would become the First Nations Equity Financing Program (FNEFP) in Budget 2024. This program will facilitate First Nations equity investment by providing loan guarantees for projects where there is a shared interest. The program’s intent is to address barriers many First Nations face accessing capital to gain meaningful representation in projects in their own territories. The Ministry of Finance held discussions with First Nations organizations, provincial government ministries, the federal government and the B.C. business community to develop the FNEFP design and implementation.

The Province is also coordinating with the federal government on its National Indigenous Loan Guarantee program announced in late 2024, as well as the federal Canada Infrastructure Bank and First Nations Financing Authority which also provides assistance for First Nations equity financing.